The advantage of being a Independent Contractor, Freelancer, Gig Worker, Micro Entrepreneur, Agent, Affiliate, 1099 Worker, Small Business Owner, is the flexibility and freedom gained with respect to how and when you work and how much you are able to earn. In most of these situations, you earn in proportion to the effort invested and the amount of time you are willing to invest. For some, the goal is to build a very successful business, for others the goal may be to increase or compliment the income already being earned.

Regardless of whether your income objectives are to earn a few hundred dollars, a few thousand dollars, or several thousand dollars, flexibility and freedom in how you work requires that you also take responsibility for how you manage your money. Employees receive paychecks which include deductions for estimated taxes and the cost of benefits you have elected to engage. The self-employed and all forms of independent contractor/1099 work means that when you are compensated, you are responsible for allocating and managing the amount of money that you will owe for taxes and the amount that you desire to invest in benefits such as insurance products and financial services. Therefore, one of the most important decisions that you can make as you start a New Year is to make sure that you are using a good book keeping system. Prerequisite and complimentary to using a good book keeping system is also a completed strategic plan for growth in the New Year. In other words, set specific goals and objectives and develop plans to support achievement.

AFE, this year, is enhancing the Personal and Business Support we provide AFE Members. We now provide free access to tools that support planning and book keeping support. Access to the LEVERAGE Planning Guide which accompanies the LEVERAGE eBook are offered to AFE Members FREE. Both are authored by AFE contributing author, John Fleming. In the eBook John discusses how to leverage underutilized assets which can be physical assets and the assets of knowledge, skills, experience and even passion and purpose. This book is very beneficial to anyone looking to better understand how to leverage their most precious assets. The LEVERAGE Planning Guide is designed to assist in completing a strategic approach to managing time and money effectively.

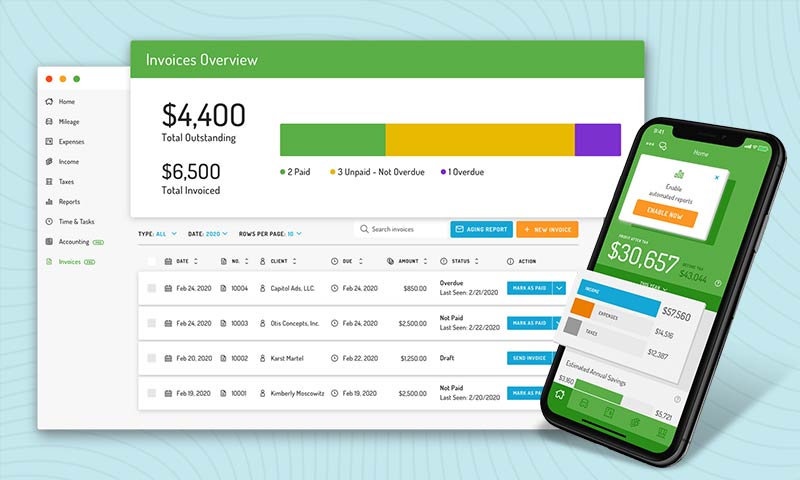

We also selected Hurdlr as the bookkeeping system that we recommend you review. In order to maximize the value of your income, regardless of the amount earned, you must take steps to ensure that you earn more than you spend or to paraphrase, spend less than you earn. The best way to ensure where you stand with the earn/spend rule to know exactly what you have earned and what expenses are associated with the earnings. The difference is profit/real income.

Use the tools and access we provide to ensure your best year ever!

Article by

Wayne Goshkarian,

Senior Advisor